Returns are a necessary inconvenience whenever you sell products, even online. It’s important to make the process as efficient and hassle-free as possible. So when it comes to issuing a refund, which method is better: store credit vs refund?

Considering store credit instead of a more traditional refund offers several advantages worth considering. While setting up a store credit system may require some effort, the benefits to your bottom line often justify the investment. What’s more, this system is easy to implement with the right tools!

In this article, we will explain what store credit is and why you should consider it. Then we will compare the benefits of using store credit vs a refund system. So, let’s get started!

Why You May Need To Offer Refunds In Your Online Store

Customers usually receive refunds when they return products. Many regions legally require refunds, at least under certain conditions.

For example, in New York, a store is legally obligated to post its refund policy. If no policy is posted, the store must accept returns within 30 days for any reason by default. Federal law mandates that refunds must be given for products that are defective or violate the terms of a sales contract.

While these laws vary by country and even state or territory, many companies choose to exceed the minimum requirements in the name of customer satisfaction.

Understanding Store Credit Vs Refunds

Store owners typically offer either a traditional refund or a store credit for compensation when shoppers return products. Let’s look into these two options in detail to help you choose which is best suited for your store.

What is store credit?

When you offer store credits to customers, you give them a redeemable virtual balance they can use in your store for future purchases. For example, you might offer a customer $20 in store credit in exchange for an item they don’t want, and they can use that $20 on anything else in your store (at any time).

Examples of store credit include:

- Gift cards

- Return credit

- Account credit

- Company currency

Store credit is usually tracked digitally. This can be through gift cards, an online account, or even an in-store record system. Some stores have even branded their form of currency that functions as store credit. Some popular examples include:

- CVS ExtraCare Bucks

- Kroger Fuel Points

- Discover CashBack

- PlayStation Virtual Wallet

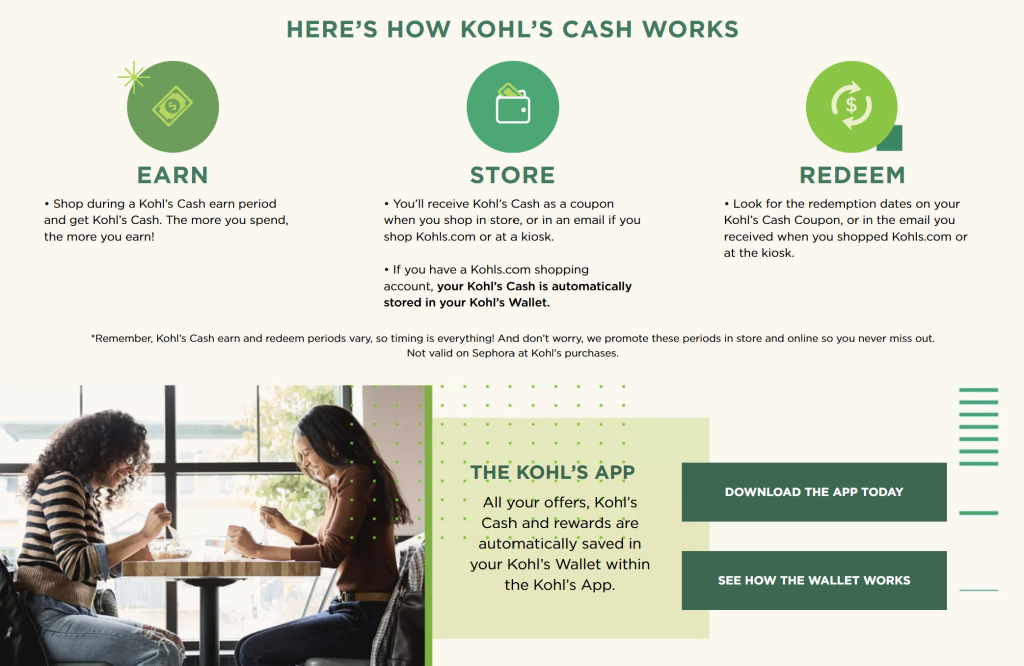

- Kohl’s Cash

These programs tend to have additional rules and restrictions but can function as a replacement for a standard refund.

What is a refund?

A traditional refund usually involves giving customers their money back in whatever form they provide. In other words, a customer who paid cash for an item will receive cash when they return it, whereas a buyer who paid with a credit or gift card will have the balance returned to that card. Companies typically do this to prevent fraud (such as turning gift cards into cash) and ensure there’s balanced bookkeeping.

The Benefits Of Offering Your Customers Store Credit vs Refunds

There are some significant benefits to offering store credit in place of a traditional refund. Sometimes, the law might require giving cash or credit refunds. But when you want to keep your customers happy even if you’re not legally obligated, offering store credit can be a great option.

Some notable advantages to using store credit over a traditional refund are:

- Encourages repeat purchases: Customers can only use issued store credits in your store, encouraging them to return and make another purchase when you send newsletters using email newsletter software to remind them about new arrivals or ongoing offers.

- Minimizes revenue loss: Issuing store credit vs refund ensures the money stays in your business.

- Creates additional marketing opportunities: Retailers can also use store credit as incentives for marketing campaigns through referral program rewards, customer loyalty programs, birthday gifts, and purchase incentives.

- May reduce return abuse and fraud: Some customers might purchase items with the intent to return them for cash. Issuing store credits can reduce this form of exploitation, helping you protect your business’s bottom line.

Having your own brand currency or store credit system is a resource that can be leveraged in several creative ways. Kohl’s Cash is a great example, motivating customers to spend more than they normally would to receive store credit for a future purchase.

How To Decide What Type of Refund Is Best For Your Store (4 Key Considerations)

Choosing between store credit vs refund can be tricky, as they impact your business in different ways. What’s more, the best choice might differ depending on the legal landscape in your region and your store’s goals. To help out, we’ve outlined four key considerations to look into:

1. Legal considerations

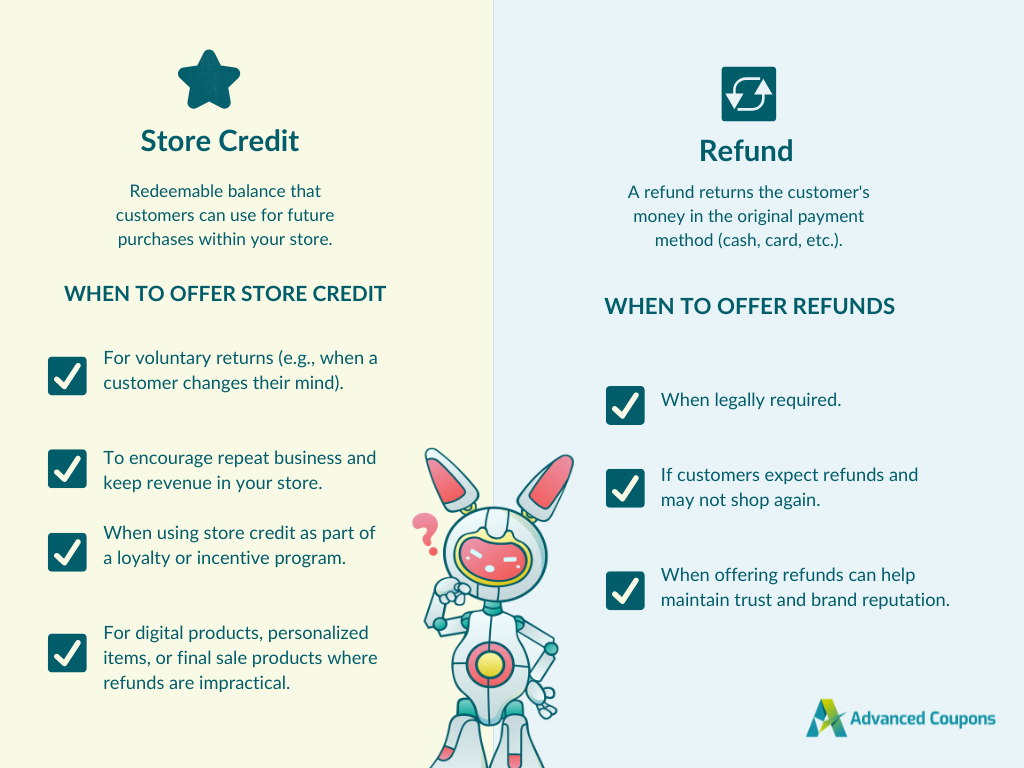

When deciding on your store’s return policy, make sure to check local laws regarding refunds. There are some regions that require full refunds under certain circumstances, such as defective products. In situations where you are required to give traditional refunds by law, refunds are appropriate. For other returns, store credits can be a better alternative.

2. Customer preferences

It’s also important to consider the unique preferences of your customer base. Some shoppers expect full refunds and may hesitate to purchase if you only offer store credits as an option. Offering both refunds and store credits can be a smart move in this situation.

3. Impact on cash flow

Opting for store credit instead of refunds may be a better option if maintaining cash flow is a top priority for your business. This can help reduce financial strain, as refunds immediately take money out of your store.

4. Implementation and management

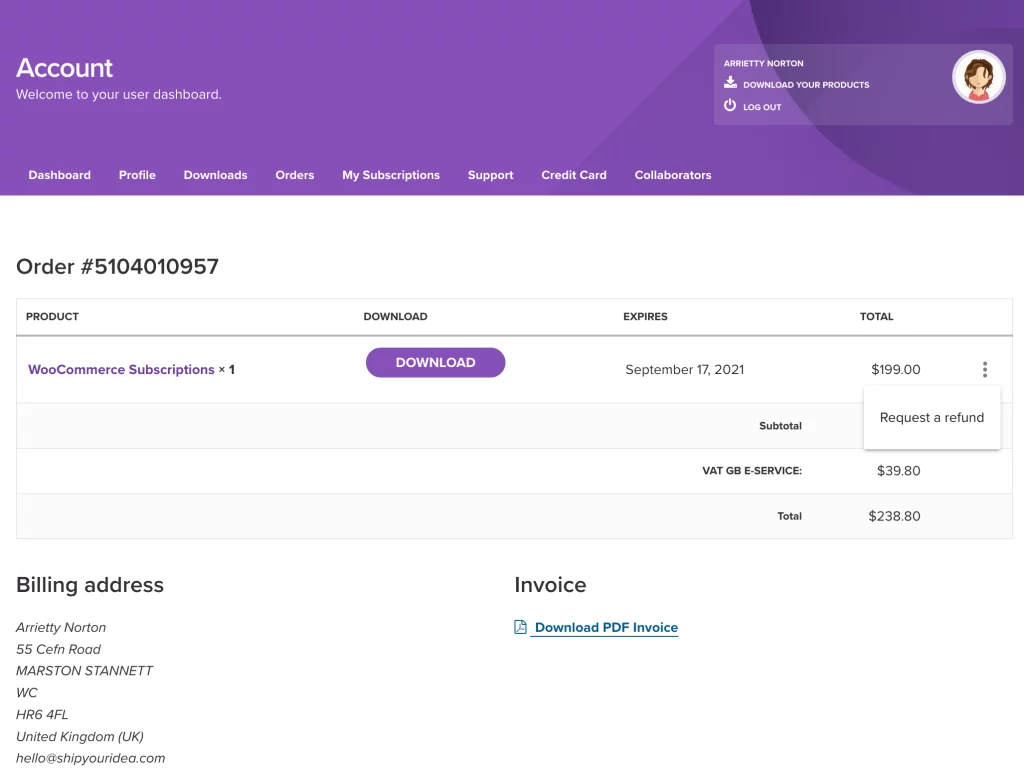

Managing store credit is different from issuing refunds which are processed through standard payment methods. Store credit functions as a redeemable balance within your store, which means you’ll need a reliable tool to efficiently issue, track, and manage store credit currency.

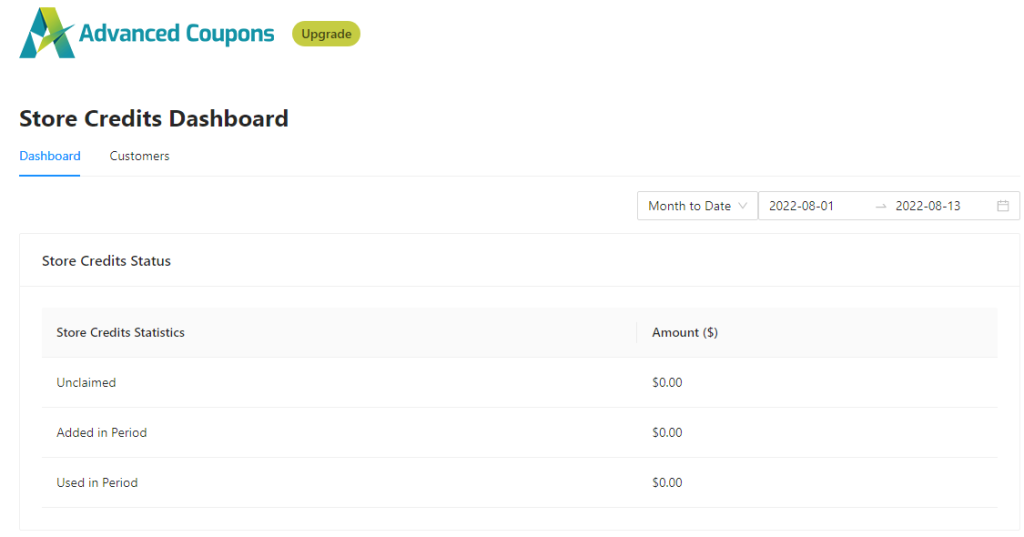

If you manage a WooCommerce store, you can use tools like Advanced Coupons for seamless store credit management. This plugin allows you to issue and manage store credits right within WooCommerce. It also gives you access to a store credit dashboard, where you can track and adjust store credit balances easily.

To sum up, here’s a quick comparison of when best to offer store credit vs refunds:

click to zoom

How To Start Offering Store Credit With Advanced Coupons

If these benefits are convincing enough for you to want to create a store credit program, Advanced Coupons offers an easy solution for implementing and managing one. Along with tools for coupons and a loyalty program, the free version of our plugin even includes a system for tracking store credit:

Once you install it, you’ll have a dedicated page for monitoring the amount of store credit added, used, and unclaimed over time.

You can also view and adjust the balance of credit for each customer in your system.

This feature can also integrate with your checkout and refund process, to automatically apply store credits where applicable. All in all, it is a straightforward solution, especially for a free plugin.

Related Resources

Want to learn more about store credit and how to use it in WooCommerce? Check out our official guides below:

- What Is Store Credit? (Benefits, Types & Best Strategies)

- How To Enhance Your WooCommerce Store Returns Policy Using Store Credits

- How To Send Store Credit Email Reminders In WooCommerce

Frequently Asked Questions

Is store credit a refund?

Store credit can be considered a form of a refund when it’s given as compensation for an item a customer is returning. However, they work differently than traditional refunds. Instead of returning the money to the customer’s original payment method, store credits provide customers with a redeemable balance they can use for future orders within the same store. This keeps the money within the business and encourages shoppers to return.

What is the difference between credit and refund?

Traditional refunds return the customer’s money in the same payment method they used for the purchase. On the other hand, store credit provides customers with a virtual balance they can use to purchase at the same store.

Why do stores give store credit?

Businesses issue store credits to reward customers, encourage them to return and reduce revenue loss for refunds. They’re a flexible tool store owners can use as a refund alternative, loyalty incentive, or even a marketing promotion.

Conclusion

While it can be tempting to simply say “no refunds”, laws and best practices generally require some allowance for returns. The simplest solution may be to just offer traditional cash or credit refunds. However, there are advantages to providing store credit instead. These include:

- No loss of revenue

- Customers returning to shop more

- New marketing opportunities

In this article, we shared everything you need to know about store credit vs refund:

- Why You May Need To Offer Refunds In Your Online Store

- What Is Store Credit?

- What Is A Refund?

- The Benefits Of Offering Your Customers Store Credits

- How To Decide What Type of Refund Is Best For Your Store (Key Considerations)

- How To Start Offering Store Credit With Advanced Coupons

If you want to set up your store credit system, our free Advanced Coupons plugin handles most of the work for you. Do you have any questions about offering store credit or refunds for returned items? Let us know in the comments section below!